In trading, there is one technical analysis technique that is

a favorite and mainstay of traders. The analysis technique is chart pattern

analysis. According to most traders, this type of analytical technique has

great potential for accuracy. It has higher accuracy than traditional

candlestick patterns, as it takes into account more candlestick formations.

However, the Chart Pattern is kept simple because you don't need to use

anything other than the price chart itself.

The problem is, not many beginner traders know the meaning of

Chart Patterns because they still rely on indicators as trading signals. In

fact, most indicators are derived from price movements on the chart itself.

Logically, if you can see the dynamics of the market with the naked eye, why

bother installing a pile of indicators?

What is Chart Pattern Analysis?

Chart pattern is a technical analysis that relies on seeing

the patterns that form in the chart. Price movements in charts tend to repeat themselves

and form the same pattern, so traders can predict future price movements by

looking at price history that has formed in the past.

Each pattern has a different shape and meaning. Chart

patterns can be useful for traders to predict prices will continue or reverse.

This technique is also useful for finding potential entry points. Mastering the

chart pattern technique is one of the easy analyzes in trading strategies

without indicators.

Once again it should be underlined, the main attraction of Chart Pattern analysis is the repeated appearance of certain price formations. So, a price formation can appear many times in a pair with the same or different timeframes. Note, too, that the market reaction is not always the same to one particular pattern.

Because, the clearer the formation of a price

pattern, the stronger the market sentiment towards that price pattern. For

example, even though in a textbook a pattern is taught to have a high

probability of predicting prices in one direction only, in reality there are

market players who actually use price patterns to trap novice players.

As already explained that chart patterns can provide information in the form of predicting price movements based on past price movements, there are several types of chart patterns.

|

| Foto oleh Lukas dari Pexels |

Types of Chart Patterns

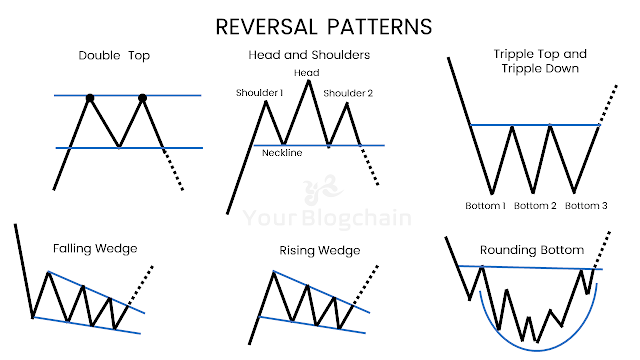

Reversal Pattern

This price pattern gives a signal that the price has a high

probability of reversing the direction of the previous main trend. This means

that price patterns in this category can provide an early signal of when you

can sell at the highs or buy at the lows.

Double Top

This price pattern is one of the price patterns with the

highest frequency of occurrence, because its formation is easily recognizable.

The Double Top formation indicates that the price tends to slow down when it

reaches its peak.

Head And Shoulders

The first and second shoulders are smaller than the head as

an indication of weakening momentum to maintain the price to its highest point

(Head). As soon as the price appears to have broken through the neckline, you

can execute a Sell order. The Head And Shoulder pattern also has its Bullish

version, namely Inverted Head And Shoulder

Triple Top and Triple Bottom

This price pattern is a variant of the previous price

pattern. The difference is, the accuracy of this pattern is slightly higher

because the price shows a strong reaction at the point of Resistance or Support.

Falling Wedge

Understanding Chart

Pattern is quite simple; if the price has started to look downwards, it means

that there is a potential that the price will reverse up. Falling Wedge also

often appears on price charts.

Rising Wedge

Simply put, this price

pattern is the Bearish version of the Falling Wedge. If the price is converging

upwards, then there is a potential that the market will respond with Sell-Off

action.

Rounding Bottom

Compared to other reversal patterns, this one pattern is quite

rare. The reason is, the Rounding Bottom formation requires a lot of

candlesticks, so you can be sure this price pattern is designed for long-term

trading.

Continuation Pattern

Unlike the Chart Pattern Reversal patterns, this time the

price pattern gives a signal that the trend will continue even though it has

reversed direction. This is quite common, especially because market movements

often experience retracements.

Flags

At first glance, the price formation of this pattern is

similar to the Trendline Channel tool. It is true, the Flag and Trend Channel

patterns are often used by traders to monitor potential breakouts from the

Resistance or Support limits (diagonal lines).

Rectangle

if the price bounces back and forth, so it's not clear where

the Top and Bottom are, it could be that you're encountering a Rectangle price

pattern.

Pennant Pattern

highlight the potential for price movement to break through

the price after a period of consolidation. At first glance this pattern is

similar to the Wedges pattern, but the difference lies in the degree of

inclination. The Wedge Pattern will lean in either direction, while the Pennant

Pattern is nearly symmetrical.

Cup With Handle

Are you hungry for profit? Quench your thirst by drinking

this beneficial juice from the Chart Pattern in a cup-like shape. This price

pattern is similar in shape to the Rounding Bottom, but the difference lies in

the consolidation of the price on the "handle".

Unfortunately, the biggest drawback of technical analysis

with price patterns is its subjectivity. Between one trader and another trader

can depart from the understanding of the Chart Pattern differently, even though

the pair, timeframe and broker are also exactly the same.

Don't be surprised if one trader gets a Buy signal, but

another trader gets the opposite signal on the same chart. The problem only

occurs if you use price pattern references from other traders as a trading

reference without considering your personal trading system.

|

| Foto oleh Anna Nekrashevich dari Pexels |

First, certain price patterns require

a long holding time, such as the Rounding Bottom which is generally intended

for long-term trading. Just imagine if you are a scalper, the accumulation of

floating minus can make you close the position early before the price reverses

direction again.

Second, the accuracy of price patterns depends on discipline in following the criteria for forming certain price patterns. There are some traders who prefer the Chart Pattern identification technique freely, so there are some requirements that are a bit deviated from the position they should be. The goal is for him to get a signal faster at the expense of accuracy.

Third, regarding accuracy, Chart Pattern signals can be combined with supporting indicators to improve their quality. It's just that you need to remember, adding a stack of indicators does not necessarily make the accuracy of the Chart Pattern signal 100%.

Patterns are the distinctive formations created by the movements of security prices on a chart and are the foundation of technical analysis