Bearish reversal is a reversal of the

direction of stock prices, which initially increased but then the trend

decreased. The pattern is the opposite of the bullish reversal described in the

previous article. Bearish reversal means that the stock price initially

increased, but the stock has the opportunity to fall again.

This means that there is an

opportunity to experience a reversal from an uptrend to a downtrend. There are

several characteristics that indicate a stock is experiencing a bearish

reversal, namely: Preceded by an increase in stock prices or experiencing an

uptrend, a bearish confirmation pattern appears.

Some bearish reversal patterns can be

analyzed from a number of candlestick patterns or chart patterns as happens

when a bullish reversal. Some bearish reversal candlestick patterns are as

follows:

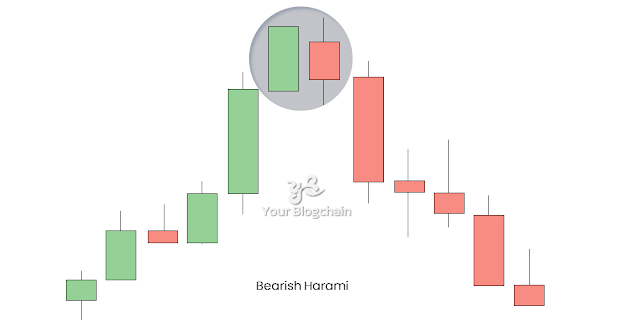

BEARISH HARAMI

Another name for Bearish

Pregnant.

2 candles format.

Started by an uptrend.

The first candle is green.

The second candle is red.

The second body candle is

inside the first body candle.

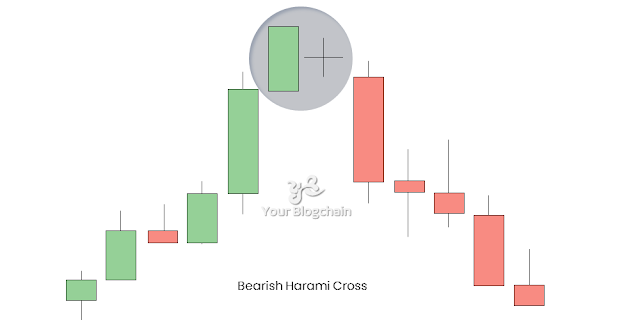

BEARISH HARAMI CROSS

Another name for Bearish Pregnant Cross.

2 candles format.

Started by an uptrend.

The first candle is green.

The second candle is in the

form of a doji.

The doji is inside the body

of the first candle.

The difference with Bearish

Pregnant only lies in the shape of the second candle, which is in the form of a

doji in this formation.

BEARISH HOMING

PIGEON

2 candles format.

Started by an uptrend.

The first candle is green.

The second candle is also green.

The second body candle is

inside the first body candle.

The difference with Bearish

Pregnant only lies in the "color" of the second candle which is green

in this formation.

MATCHING HIGH

2 candles format.

Started by an uptrend.

The first candle is green.

The second candle is also green.

Very similar to Bearish

Homing Pigeon.

The difference lies only in

the closing price of the candle

the second is the same as

the closing price of the first candle in this Matching High pattern.

BEARISH

ENGULFING

2 candles format.

Started by an uptrend.

The first candle is green.

The second candle is red.

The first body candle is

inside the second body candle.

DARK CLOUD COVER

2 candles format.

Started by an uptrend.

The first candle is green.

The second candle is red.

The opening price of the

second candle is above the closing price of the first candle.

But then the closing price

of the second candle passed (below) the middle of the body of the first candle.

TWEEZER TOP

2 candles format.

Started by an uptrend.

The first candle is green.

The second candle is red.

What is noticed in this

pattern is the highest price of the first candle and the highest price of the

same second candle.